Urgent Cash Loan – Sydney

U-Pawn – Urgent Cash Loans to $50,000

from Sydney’s leading Car Pawnbroker

☎️ 1300 205 558

❌ No Credit Checks

❌ No Establishment Fees

❌ No Repayments First 3 Mths

$$ Urgent Cash Loans !!! $$

An urgent cash loan is usually a short-term loan, designed to provide the funds people might need in an emergency. The money can be used for just about any purpose, from urgent car repairs to paying essential bills, and usually in the terms of a pawn loan must be repaid during a term ranging up to 90 days.

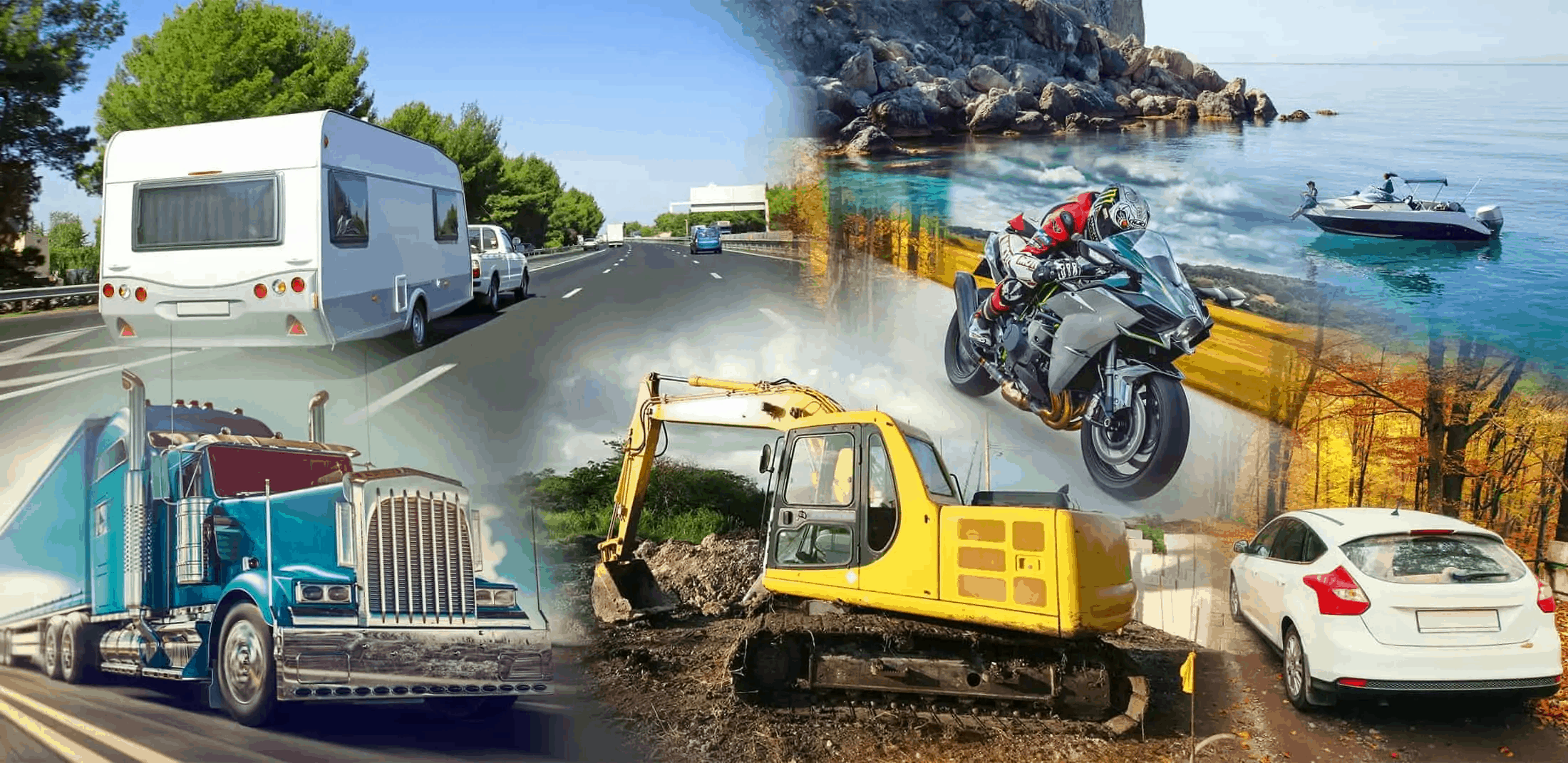

Perhaps you’ve received an unexpected bill, need medical treatment, or just need a little extra cash to help family and friends – whatever the reason, we’re here to help. Indeed, sometimes life doesn’t go to plan. That’s when U-Pawn can provide you an urgent cash loan secured against your Car, Motorbike, Truck, or Boat. We also pawn Machinery, Recreational Vehicles, Caravans, Trailers, Farm Equipment, and even Aircraft.

We aim to keep it simple.

Forget the piles of paperwork, scanners, and long waits. We make getting an urgent cash loan quick and simple without the need for credit rating checks, employment history checks, or establishment fees.

Phone Us ☎️ 1300 205 558 or fill out our Online Enquiry Form and we’ll call you. Better still, we can come to you and offer a free pawn-value appraisal of what you would like to pawn.

Urgent Cash Loans Immediately

You can get a cash loan right now – no credit check to slow things down- -you don’t have to tell anyone what you want the cash for– just bring us your car, motorcycle, boat, truck or other valuables and all being well we’ll offer you a cash loan on the spot. It’s that simple – learn more about our urgent cash loans >>

Indeed, an emergency cash loan can be used for a wide range of purposes including for:

- Medical fees

- Legal costs

- Vet bills

- Rental bond or deposit

- Business expenses

- Utility bills

- Car or vehicle repairs

- Travel & accommodation

- Holiday expenses

- School or education fees

- Car Rego’ bill

- Professional Fees

- Tax bill

- Traffic fines

- Home repairs

- Moving costs

- Presents or gifts

- Funeral costs

What amount will we lend to?

Urgent cash loans are available from $1,000 to $50,000 (sometimes more on request).

The amount we will loan depends on the value of the goods being pawned. It will be unlikely you could borrow the full value of the goods. Generally, a pawn shop will only lend about 50% to 60% of the wholesale value of the goods. So, using a car for example, if you have a car with a pawn value of $30,000 you might be able to borrow a maximum of around $18,000 perhaps a few thousand more depending on the condition of the car.

For your convenience, once approved, we’ll process your loan in just minutes and provide you cash in hand or an immediate bank transfer to an account of choice. We’re flexible either way. The point is, pawn loans are almost always cash loans. This is why pawn loans are so popular these days.

Another reason for the popularity of pawn loans is that no one knows that you’re getting a cash loan because it doesn’t go through your bank account and is not registered on your credit rating file. So your privacy and discretion are assured. If you have a bad credit rating or you are being chased for cash, getting a cash loan against something you own by pawning it with us is a logical and quick solution to your immediate cash flow problems. No one needs to know but you.

Note: We are not a payday or personal loan lender.

Usual Loan Terms

Loans are set for three months, however, repayment of the loan can be made earlier without penalty fees. Loans may be extended past the three-month period subject to additional conditions. Borrowers have the right to pay interest periodically or at the expiry of the loan.

Indeed, many of our customers need an urgent cash loan for just a few days or a few weeks to get them over a financial hump or they might be having to put their financials together to arrange a traditional loan. Many self-employed people don’t have their books right up to date and it might take their accountant a few weeks to put in order to present to a bank. A loan against your car for example can tide you over during this period.

Usual Loan Conditions

Pawning your “asset” means we will use it as security. We will keep possession of the asset for the duration of the loan. Therefore your credit rating is immaterial to borrowing money from a pawnbroker.

You must have legal and ownership rights to the asset you wish to pawn. The asset should have nil (or virtually nil) finance owing on it. If the asset has money owing on it we would need to consider the circumstances before offering to pawn it.

U-Pawn is a high-value collateral lender specialising in pawning Cars | Motorcycles | Boats and Trucks. From time to time we also pawn Heavy Machinery | Recreational Vehicles | Caravans | Trailers | Farm Equipment and even Aircraft.

To learn more about getting an urgent cash loan please visit the relevant page for the asset you want to pawn:

FAQS

Frequently Asked Questions

Do I have to be 18+ to pawn something?

Yes – To pawn something in NSW you must have attained at least 18+ years of age.

Does a bad credit rating matter?

People ask – can I get an urgent cash loan with a bad credit rating? – the short answer is Yes. Your good or bad credit rating is not a reflection in obtaining a cash loan from us because you are pledging your property as collateral for a loan by handing whatever it is over to us until your loan (and any interest due) is repaid in full. This is the essence of pawning as you are using your asset -a car for example- as collateral for a loan.

Indeed, if you need an urgent cash or if you have a bad credit rating you may struggle to find a loan company willing to take the risk of lending to you on urgent notice or at all. Perhaps your credit cards are maxed-out; unless you have a standing line of credit with a bank like an overdraft or a mortgage drawdown facility you might struggle to get a loan quickly; that’s why getting a loan against something like a car by pawning it is often the best way to get an urgent cash loan. The great thing is, you can borrow money that you need right now for any reason.

Besides, credit checks aren’t always the best way to find out if someone is suitable for a loan. There can be many reasons why people have a bad credit rating, from not being on the electoral roll to being financially linked to someone with poor credit, so borrowing against your asset’s equity can be a good alternative in these situations. Learn more about bad credit loans >